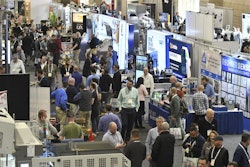

It's hard to get your bearings at the PLMA (Private Label Manufacturer's Association) show at Rosemont Expo Center. There is such a wide variety of booths, and at first glance, I'm not sure what some offer or why they exhibit.

Yes, there are literally hundreds of food, pharmaceutical, health and beauty companies hoping to sign the big retail contract. And a lot of retail buyers walking the floor. I must confess I followed a team from Dollar General around for a few minutes!

But there are also booths offering licensing of ingredients, retail research services, package design firms, even packaging suppliers like Liquid Container, Graphic Packaging or MWV.

I chatted a few minutes with Thomas Prendergast, PLMA's Director of Research Services, and he helped me understand a little more about the market.

It is fragmented, and filled with small and medium size players, most privately held. “People ask me what are the top ten private label pharma companies,” he said, “and it's almost impossible to tell, because they are privately held and don't release numbers.”

The growth on the pharma side alone has been explosive. One source said he's been coming for 18 years and back then there were maybe five pharma companies. This year's directory is filled with at least a dozen pages of OTC products, everything from dandruff shampoo to foot ointment--all doing off-patent, generic meds for distribution around the world.

As one exhibitor told me, “this is a very close-knit group of suppliers who know each other, our strengths and weaknesses, very well. “Many are located on the East Coast and trade employees back and forth.

Interesting observations: A private label supplier will often get the contract with a price point. “I need a box of breakfast cereal equivalent in quality to the national brand, and I will pay you a buck a box for it.”

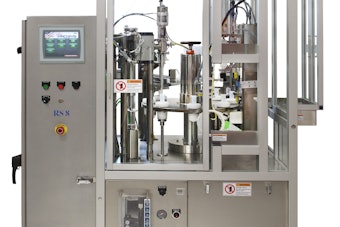

Most of the development cost is in the products itself—ingredients, testing, batch blending, etc. The package is still the point where the private label player can save a few cents, increasing his margin on his fixed-price item.

Yes we have heard how major retailers are upping the ante in packaging design, but this is the cream of the crop. Most booths at the show are exhibiting less expensive product, not innovative packaging. (The exception to this rule was in the beauty aisles, where containers and labels WERE more sophisticated.)

The problem is, the private label folks know how to produce a less expensive product. In a lot of cases they do not have any experienced packaging personnel on board, and will count on converters or printers to offer advice. Graphics gets a lot of attention. Materials science does not.

In fact, for this very reason, retailers are taking a bigger interest in this show, and in package design. These retailers need to take a lesson from the private label greats in the UK like Tesco. Tesco has learned that it does not pay to segment teams; one frozen, one breakfast cereals, one housewares, one OTC, etc. They approach it as a total brand so there is consistency to the package design.

In the US retailers may make package design decisions utilizing store brand rules, but since materials and structural design vary from department to department, a consistent color theme may look inconsistent because of the variety of “whites” in the color spectrum--bright white to ivory to almost beige. Private labels' higher use of recycled board, for instance, is much higher than national brands. An inconsistent supply of recycled board means that even packages in the same display case or on the same shelf may vary because of the variations in the board that's supplied.

So when a shopper has a cart full of retail store brand products, there may be huge variations in printing, paperboard quality, etc. Retailers have to approach private label from a total store brand perspective.

And cheaper materials, used to cut costs, end up reflecting badly on the store brand. In one booth I heard a real myth buster. “Everyone quotes the huge growth of private label by citing the now famous quote that 80% of consumers are willing to buy private label products.” He said what is often lost is the next sentence, which reads something like “but these same consumers say they will not buy private label if the package looks cheap!”

To get your daily dose of packaging trends, follow me on Twitter.

-By Jim Chrzan, Associate Publisher

Yes, there are literally hundreds of food, pharmaceutical, health and beauty companies hoping to sign the big retail contract. And a lot of retail buyers walking the floor. I must confess I followed a team from Dollar General around for a few minutes!

But there are also booths offering licensing of ingredients, retail research services, package design firms, even packaging suppliers like Liquid Container, Graphic Packaging or MWV.

I chatted a few minutes with Thomas Prendergast, PLMA's Director of Research Services, and he helped me understand a little more about the market.

It is fragmented, and filled with small and medium size players, most privately held. “People ask me what are the top ten private label pharma companies,” he said, “and it's almost impossible to tell, because they are privately held and don't release numbers.”

The growth on the pharma side alone has been explosive. One source said he's been coming for 18 years and back then there were maybe five pharma companies. This year's directory is filled with at least a dozen pages of OTC products, everything from dandruff shampoo to foot ointment--all doing off-patent, generic meds for distribution around the world.

As one exhibitor told me, “this is a very close-knit group of suppliers who know each other, our strengths and weaknesses, very well. “Many are located on the East Coast and trade employees back and forth.

Interesting observations: A private label supplier will often get the contract with a price point. “I need a box of breakfast cereal equivalent in quality to the national brand, and I will pay you a buck a box for it.”

Most of the development cost is in the products itself—ingredients, testing, batch blending, etc. The package is still the point where the private label player can save a few cents, increasing his margin on his fixed-price item.

Yes we have heard how major retailers are upping the ante in packaging design, but this is the cream of the crop. Most booths at the show are exhibiting less expensive product, not innovative packaging. (The exception to this rule was in the beauty aisles, where containers and labels WERE more sophisticated.)

The problem is, the private label folks know how to produce a less expensive product. In a lot of cases they do not have any experienced packaging personnel on board, and will count on converters or printers to offer advice. Graphics gets a lot of attention. Materials science does not.

In fact, for this very reason, retailers are taking a bigger interest in this show, and in package design. These retailers need to take a lesson from the private label greats in the UK like Tesco. Tesco has learned that it does not pay to segment teams; one frozen, one breakfast cereals, one housewares, one OTC, etc. They approach it as a total brand so there is consistency to the package design.

In the US retailers may make package design decisions utilizing store brand rules, but since materials and structural design vary from department to department, a consistent color theme may look inconsistent because of the variety of “whites” in the color spectrum--bright white to ivory to almost beige. Private labels' higher use of recycled board, for instance, is much higher than national brands. An inconsistent supply of recycled board means that even packages in the same display case or on the same shelf may vary because of the variations in the board that's supplied.

So when a shopper has a cart full of retail store brand products, there may be huge variations in printing, paperboard quality, etc. Retailers have to approach private label from a total store brand perspective.

And cheaper materials, used to cut costs, end up reflecting badly on the store brand. In one booth I heard a real myth buster. “Everyone quotes the huge growth of private label by citing the now famous quote that 80% of consumers are willing to buy private label products.” He said what is often lost is the next sentence, which reads something like “but these same consumers say they will not buy private label if the package looks cheap!”

To get your daily dose of packaging trends, follow me on Twitter.

-By Jim Chrzan, Associate Publisher