Since global packaging is the primary theme of this issue, Healthcare Packaging asked Packaging Hall of Fame inductee Ed Bauer for his opinion on how the U.S. stacks up against the rest of the world when it comes to packaging technology.

“In the pharmaceutical arena, if you look at blister packaging, the U.S. trails the European market by an awful lot,” says Bauer, who recently retired from GNC. Why is that? “I think it comes down to investment and commitment to the marketplace. Equipment suppliers such as Bosch, SIG, Krones are the ones making the investments in versatile technologies.” Another example, he says, is in aseptics, such as for low-acid beverages. “Off-hand, I can't think of a U.S. company that would be able to supply that technology.

“If I want a piece of blister equipment, I can get reconditioned equipment in the U.S., and have it upgraded with new controls, but the original, new equipment is essentially European,” he contends, adding, “you are starting to see some of the Asian and other countries get into it now.”

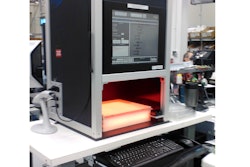

That said, Pharmaworks does indeed engineer and manufacture new blister thermoforming equipment in Odessa, FL, including the TF1, TF1e, TF2X, and TF3. It also has rebuilt and updated competitors' machines for the past 10 years. The company's Web site says, “For the past decade, we've set the pace of innovation for thermoformer manufacturers and rebuilders all over the world. And why shouldn't we expect this from an American company?”

Packaging materials

And what about the competitive picture in packaging materials? “I think the U.S. companies have had materials available for exploiting it into packaging. I think the Europeans have been much quicker at taking a look at these materials and understanding what the technical use may be,” says Bauer.

The stand-up pouch's growth in the U.S. serves as an example. Bauer notes, “One of the problems for a lot of the end-users in the U.S. is the cost of investment. When pouches became all the rage, it really began with the Koreans having excess capacity for tuna products on their pouching lines. At the same time, U.S. manufacturers saw the pouches as an alternative to cans. However, when they started looking at replacement cost, that is replacing cans with flexible pouches, even with slightly lower material costs for flexible packaging, you couldn't save enough money to pay for the new capital investment,” in pouching machinery, he says.

Additional factors

In an era where pharmaceutical firms are under considerable pressure to reduce costs, capital expenses for new machinery could slow the move toward personalized medicine. Says Bauer, “When you look at personalized medicine, which is coming, and we're moving more and more in that direction, you've got all these packaging machines that have been designed over the years to do high rate-per-minute production.”

Packaging for patient compliance also differs globally. “Europe was always in blisters,” he says. “They did it for two reasons: most of those were government-controlled, for one, and two, they were looking at it as a means of cost containment.”

Today, Europeans would likely dread the idea of a pharmacist filling a prescription by dispensing pills from a large bottle into a patient's Rx bottle, as is common in the U.S. Bauer says consumer preferences vary geographically, citing the Europeans fondness for shelf-stable milk that's not refrigerated, an issue that likely goes back to the more robust refrigerated distribution system in the U.S.

--By Jim Butschli, Editor

“In the pharmaceutical arena, if you look at blister packaging, the U.S. trails the European market by an awful lot,” says Bauer, who recently retired from GNC. Why is that? “I think it comes down to investment and commitment to the marketplace. Equipment suppliers such as Bosch, SIG, Krones are the ones making the investments in versatile technologies.” Another example, he says, is in aseptics, such as for low-acid beverages. “Off-hand, I can't think of a U.S. company that would be able to supply that technology.

“If I want a piece of blister equipment, I can get reconditioned equipment in the U.S., and have it upgraded with new controls, but the original, new equipment is essentially European,” he contends, adding, “you are starting to see some of the Asian and other countries get into it now.”

That said, Pharmaworks does indeed engineer and manufacture new blister thermoforming equipment in Odessa, FL, including the TF1, TF1e, TF2X, and TF3. It also has rebuilt and updated competitors' machines for the past 10 years. The company's Web site says, “For the past decade, we've set the pace of innovation for thermoformer manufacturers and rebuilders all over the world. And why shouldn't we expect this from an American company?”

Packaging materials

And what about the competitive picture in packaging materials? “I think the U.S. companies have had materials available for exploiting it into packaging. I think the Europeans have been much quicker at taking a look at these materials and understanding what the technical use may be,” says Bauer.

The stand-up pouch's growth in the U.S. serves as an example. Bauer notes, “One of the problems for a lot of the end-users in the U.S. is the cost of investment. When pouches became all the rage, it really began with the Koreans having excess capacity for tuna products on their pouching lines. At the same time, U.S. manufacturers saw the pouches as an alternative to cans. However, when they started looking at replacement cost, that is replacing cans with flexible pouches, even with slightly lower material costs for flexible packaging, you couldn't save enough money to pay for the new capital investment,” in pouching machinery, he says.

Additional factors

In an era where pharmaceutical firms are under considerable pressure to reduce costs, capital expenses for new machinery could slow the move toward personalized medicine. Says Bauer, “When you look at personalized medicine, which is coming, and we're moving more and more in that direction, you've got all these packaging machines that have been designed over the years to do high rate-per-minute production.”

Packaging for patient compliance also differs globally. “Europe was always in blisters,” he says. “They did it for two reasons: most of those were government-controlled, for one, and two, they were looking at it as a means of cost containment.”

Today, Europeans would likely dread the idea of a pharmacist filling a prescription by dispensing pills from a large bottle into a patient's Rx bottle, as is common in the U.S. Bauer says consumer preferences vary geographically, citing the Europeans fondness for shelf-stable milk that's not refrigerated, an issue that likely goes back to the more robust refrigerated distribution system in the U.S.

--By Jim Butschli, Editor