Given an uncertain economic and regulatory scenario, particularly in regard to serialization, it’s understandable that a company would maintain a tight grip on capital spending. However, it’s in this most challenging business climate that Packaging Coordinators Inc. (PCI) sees opportunities as a contract packager.

“We have invested substantially in facilities and packaging equipment in the past year,” exclaims Justin Schroeder, PCI’s Senior Director of Marketing and Development Services. “There are many exciting developments that we see going on as a contract packager of clinical trials and commercial products within pharmaceuticals, biologics, medical devices, and drug delivery in general.”

In May, Frazier Healthcare and PCI announced the completion of the acquisition of pharmaceutical packager AndersonBrecon from its parent company AmerisourceBergen Corp., with AndersonBrecon merging with and operating as PCI. PCI provides customized pharmaceutical and biotechnology packaging, with facilities in Philadelphia, Woodstock, IL, Rockford, IL, and the U.K.

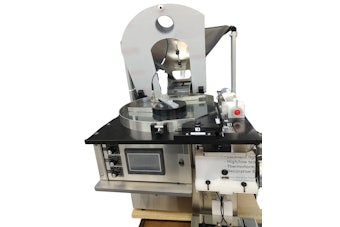

As the July/August 2013 issue of Healthcare Packaging (HCP) went to press, the Rockford location was changing over its signage from AndersonBrecon to PCI. Rockford now is home to nine physical sites, encompassing more than 1 million sq ft of space. Much of the recent financial investment was made at Rockford’s Plant 2, which produces both primary and secondary pharmaceutical packaging. At the heart of the company’s packaging machinery investment within the 410,000-sq-ft Plant 2 are three new blister-packing machines from Uhlmann, and two bottling lines from IMA.

Virtually all of PCI’s packaging lines are configured in a linear/straight-line fashion that enables easy access for maintenance and changeover. All lines are either already installed or are in the process of being qualified for production. All are all solid-dose packaging lines housed within newly developed “suites,” or packaging rooms. Each suite is carefully controlled with specific air handling/air flow, temperature and humidity controls, and anterooms.

The lines run five days a week on three daily shifts, occasionally on weekends, depending on customer demand, producing over-the-counter and prescription product packaging.

“Across the board, the investments at the site are to support business growth,” says Schroeder. “It requires a significant amount of money to keep up with demand. The lines help us support our commercial medicines and clinical/investigational drugs for global customers.”

HCP spoke with Schroeder on a range of issues in the following question-and-answer discussion:

HCP: Tell us a bit about the materials PCI plans to run on the new equipment.

Schroeder: On the Uhlmann equipment, we are running thermoformed and cold-form blister packaging. These blister materials could include Aclar, PVC [polyvinyl chloride], and PVDC [polyvinylidene chloride], polypropylene, COCs [cyclic olefin copolymers], as well as three- and four-ply cold-form structures. We don’t rely on one particular material supplier. We need to be flexible to support the specifications of all our clients, so it’s a pretty diverse range of components, suppliers, and product forms.

The bottling lines are also designed to support a variety of bottle types, including round, square, blake [oblong], and various closure styles.

HCP: That said, you have three blister lines with the same kind of equipment, yes?

Schroder: We have been very pleased with the Uhlmann equipment, and we utilize the consistent footprint of their machinery in our facility, particularly the UPS-4 line, which offers us a lot of flexibility benefits for our clients in terms of being able to validate multiple lines and gives them business continuity.

Using the same equipment also provides benefits for our Process Reliability Technicians, or PRTs, who are trained on the same type of equipment. There are many advantages there in terms of being able to operate and change over that equipment. We’ve found that the Uhlmann lines are very flexible in terms of what they can support. It’s is a nice platform for us, so we try to keep that consistency. We have also invested in smaller-format equipment to support smaller batch sizes. This equipment includes several narrower-web thermoformers from Pharmaworks.

HCP: As you know, there is much uncertainty with regard to serialization. In a recent HCP article, you were quoted as saying, “I don't think you should be surprised that U.S. companies have not made more progress on serialization. Most are waiting to see how the regulations play out. It is a substantial investment in time, resources, and capital expense with very few standards in place due to the evolving state, national, and international requirements. I don’t think people appreciate the scale of the investment required." With that background, tell us what you see regarding this important subject.

Schroeder: From our perspective as a global contract packaging partner, we have more than 100 different clients. Companies are trying to sort out the shifting requirements between California and the U.S. government, with different versions for both the House and Senate. And for companies doing business outside the U.S., consider that France has requirements, Turkey does as well, etc. So as a contract packager producing for companies with global business operations, we are trying to balance all of these different needs and requirements, yet maintain flexible and efficient operations. To do that, we now have a staff of full-time professionals dedicated exclusively to helping customers with serialization efforts.

HCP: It seems that it can be an almost overwhelming task for you and your customers, yes?

Schroeder: Our customers are coming to us and looking for our expertise. They don’t want to necessarily invest in all the significant capital costs, personnel resources, and the learning curve necessary for serialization. So, we have had to be out in front on this issue to be able to give our clients the best-in-class service they expect from a strategic partner.

I think the biggest challenge is that there isn’t one requirement. For example, you’ve got a different standard between what the state of California wants versus what a country like Turkey wants. So you’ve got to keep that flexibility in your packaging lines to be able to adapt to each market, and they may be quite divergent.

The second issue—one that you don’t see a whole lot of press about—is that we foresee the need for expertise and resources to support the impact of serialization changes for labeling. A major challenge here is to allow enough real estate to be able to accommodate 2D codes and human-readable codes and the impact on the artwork.

A great example is a globally marketed prescription product that we support. We manage more than 90 different SKUs for this product. So, obviously there’s a lot of labeling changes associated with serializing all those products. You have a bottle label for each SKU, a carton label for each SKU, and so on. The amount of copy change that is required is almost exponential. This is a product going into several countries with varying serialization requirements on the books or pending finalization, which adds to the complexity.

It requires a lot of graphic changes to the actual artwork. Then somebody has to manage all of these specifications, the proof approvals, and the implementation of those inventories. It’s really a full-time job in and of itself.

HCP: Those codes or labels could go on the primary and/or secondary packaging?

Schroeder: We anticipate that whatever the unit of sale is, it’s going to require that code, as will any ancillary packaging. So if you’ve got a bottle going into a carton, then that carton is going to need that code, and in all likelihood, the tray that holds the cartons may need its related code. Then the shipper will need its related code. The carton, tray, and case codes would then be aggregated within the data sent to the client. It’s a considerable amount of data to manage.

HCP: As great a challenge as this is, it does create business for packaging, doesn’t it?

Schroeder: It represents a significant investment. It’s likely that nobody really fully appreciates the involvement and investment in man-hours as well as the capital costs. It really depends on the complexity of the line. But we have seen, depending on the complexity of the line, it could involve multiple hundreds of thousands of dollars per line. It all depends on what you are trying to accomplish.

HCP: Beyond packaging line changes, primarily to coding, labeling, or printing equipment, what is involved regarding serialization through distribution and storage of this information?

Schroeder: There are inventory requirements for the manufacturers as they roll these into their marketplace. They need to identify that they have the right product and they can validate the serialized numbers as well as the pedigree of the drug supply chain. All of that is yet to be put in place.

The mechanism of validation for those individual packages in the market is an issue. For those products we are actively serializing, what is anybody doing with that information? Are they going to a universal cloud-based system where they can validate that it’s the right product or not? Again, there are many things to be determined. I don’t see any other way [to achieve this beside a cloud-based approach]. Otherwise, you will have a whole lot of piecemeal systems. I think there are going to be technology companies that serve these cloud-based systems so they can have a common platform for all the different manufacturers.

With a cloud-based system, you would be able to scan a barcode that would represent a number. That number would be entered into a website that would tell you if that code is a good or bad number, or if the number reveals that product didn’t go through the proper supply chain to be able to get to the end user.

HCP: Who is going to be checking on this?

Schroeder: It might be the wholesalers through a track-and-trace system, but ultimately it should be the pharmacist or the consumer validating that the product that is good and that it went through the proper channels. If we are doing our due diligence, the consumer should be the one who is able to validate that they have the right product. This entire effort is really about ensuring patient safety, and that is what we are committed to providing.

There are many logistical points in today’s pharmaceutical supply chain. Ensuring unadulterated product makes it to the end consumer is paramount.

HCP: Could global serialization efforts take years before being finalized?

Schroeder: The entire industry has been waiting for some type of regulation to force their hand. It will be interesting to see if the bills in the U.S. House and Senate ultimately help drive global standardization or might adversely affect the momentum from the California requirements.

HCP: Beyond serialization, are there any other key issues that affect PCI in terms of packaging?

Schroeder: We have expanded our footprint so that we now have 14 facilities across the globe, with 2,000 associates. For biotech products specifically, we have added significantly to our cold chain storage due to their specialized requirements. In our Rockford location alone, we have added over 250 pallet spaces of storage at 2° to 8° Celsius in 2012 and again in 2013. This brings us up to over 1,000 pallet positions of cold chain storage at this site. We have also added Cold Chain storage at -20° Celsius and -80° Celsius in support of growth in clinical (investigational) medicines.

We continue to see trends in terms of an expansion of different delivery forms like biologics as injectable products. We are seeing a lot more device requests where people are looking at alternative delivery forms, particularly in biotech products. We seek to drive better consumer convenience, and that changes the complexity of what the packager is responsible for.

For some of these products, such as autoinjector devices and devices for infusion, the packaging complexity is significantly increased. However, the end product is far simpler and easier for the patient. In some instances this new delivery form may enable them to self-deliver rather than travel to a clinic to receive every treatment. You can see how this would positively affect patient adherence to their medication and ultimately lead to better patient health.

HCP: What do you envision as packaging’s role as home healthcare evolves?

Schroeder: We are seeing requests for infusion-type devices, where rather than going to a clinic and having a nurse or professional set up and deliver your infusion, you as a patient might be able to do it at home. Perhaps you just pop a cartridge into a device that is hooked on your belt. It does it through a dermal delivery form. These are beginning to employ microneedles, which is very exciting. Again, the convenience to the consumer is so much better because now you can do it by yourself without requiring a trained professional.