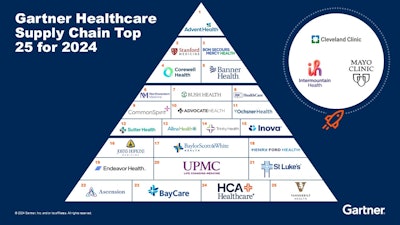

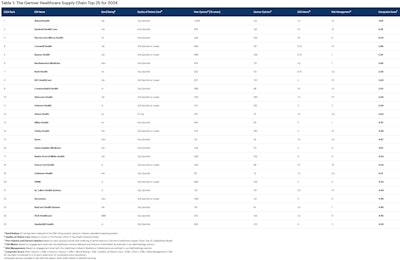

Gartner, Inc. has released its 16th annual Gartner Healthcare Supply Chain Top 25 ranking, which recognizes U.S. health systems that demonstrate leadership in supply chain.

AdventHealth claims the top spot for the first time, jumping two spots from 2023. Stanford Health Care, Bon Secours Mercy Health, Corewell Health and Banner Health round out the top five (see Table 1). Inova, Endeavor Health, St. Luke’s Health System and Vanderbilt Health debut on the 2024 ranking, while BayCare Health System and HCA Healthcare return this year.

“In 2024, health system supply chains have been strained and service has been impacted by ongoing disruption, from natural disasters to port closures, especially in recent months,” said Eric O’Daffer, Vice President Analyst in Gartner’s Supply Chain practice. “Amid a challenging environment, leading health systems have placed a greater emphasis on risk management while continuing to build improved capabilities in their supply chains by prioritizing clinical alignment, increasing organizational collaboration and accelerating the digital supply chain.”

For the Healthcare Supply Chain Top 25 for 2024, Gartner has added a quantitative risk management component to the ranking to credit health systems for taking a leading role in their approach to risk management. Twelve health systems in the Top 25 and Masters received a score of 10 out of 10 for risk management and 23 received some credit in this area.

In its seventh year, the Healthcare Supply Chain Top 25 Masters category recognizes sustained supply chain leadership at health systems. This recognition is awarded only to supply chains that have achieved a top-five score at least seven times in the past 10 years. Cleveland Clinic attains Masters status for the first time joining Mayo Clinic and Intermountain Healthcare who have both achieved Masters status for seven years in a row.

Gartner

Gartner

Resurgence of Clinical Alignment

Leading health systems are demonstrating a renewed commitment to improving processes, investing in technology and integrating systems to enhance service delivery in clinical areas. This includes a growing emphasis on providing clinicians with better decision-making tools to identify areas of unnecessary supply variation between facilities or individual practitioners. This focus aims to minimize the impact on patient outcomes while controlling costs.

“We have found a lack of investment in the clinical side of supply chain operations by most organizations, with only 3% of the overall supply chain budget allocated to the clinical side,” noted O’Daffer. “The top 25 healthcare supply chains invest a higher percentage to work more closely with clinical areas. These efforts include managing preference/procedure cards, controlling inventory, reducing unnecessary variations and tracking costs per case.”

Improving Span of Control

The health system supply chain is involved in only 72% of the organization’s spending, indicating that on average 28% remains unmanaged centrally, according to Gartner research. Even more concerning is that health systems with net patient revenue under $5 billion, have unmanaged spend reaching 38% on average. Leading health systems are addressing this gap by broadening the influence of the supply chain through greater organizational collaboration. By doing so, they are being invited to play a role in spend allocation happening in a greater number of areas like pharmaceuticals, information technology and large categories of purchased services.

Accelerating the Digital Supply Chain

Health systems are significantly increasing their adoption of digital solutions, automation tools and analytics solutions to enhance their supply chain operations. Initiatives include implementing warehouse automation systems, utilizing robotics and AI-driven solutions for inventory management. Continuous adoption of digital solutions will drive improvements in supply chain operations, ultimately leading to enhanced efficiency, cost savings and better patient care.

Gartner clients can read more in The Healthcare Supply Chain Top 25 for 2024.

Additional analysis on the Healthcare Supply Chain Top 25 is also available in the complimentary Gartner webinar.

About the Healthcare Supply Chain Top 25 Methodology

The Healthcare Supply Chain Top 25 ranking is derived from two main analyses: quantitative measures and opinion components. Quantitative measures provide a view into how companies have performed in the past and establish proxy connections between financial health, quality of patient care, ESG, risk management and supply chain excellence. The opinion components offer a qualitative assessment of value chain leadership and demonstrated supply chain performance — crucial characteristics of our Top 25. The qualitative and quantitative components are combined into a total composite score.