Regulations will have the greatest impact on the future of temperature-controlled packaging, followed by growth in biological drug therapies and vaccines and rising logistics costs.

Those findings were revealed in a survey entitled, “Assessing The Future Of The Cold Chain Industry,” conducted between Feb. 26 and July 13, 2014 by Sonoco ThermoSafe. The survey was analyzed and prepared by Kevin O’Donnell, Senior Partner, Exelsius.

The survey was presented by Sonoco Thermosafe largely in video form during an Oct. 2, 2014 presentation, “The State of the Industry & Future Outlook,” during the 12th Annual Cold Chain GDP & Temperature Management Logistics Global Forum held Sept. 29-Oct. 3, 2014 in Boston.

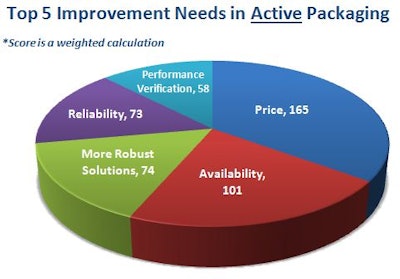

The top areas in active shipping containers in most need of improvement ranked by survey respondents were price, availability, more robust solutions, reliability, and performance verification. The scores shown on the accompanying chart is a weighted calculation.

In the glossary of a World Health Organization (WHO) Technical supplement dated Jan. 2014, active systems are defined as “Externally powered or on-board powered systems using electricity or other fuel source to maintain a temperature-control led environment inside an insulated enclosure under thermostatic regulation (e.g. cold rooms, refrigerators, temperature-controlled trucks, refrigerated ocean and air containers).”

Meanwhile, respondents ranked package efficiency, total cost of ownership, lower package price, ease of assembly, and reusability as the highest areas in passive temperature-controlled packaging in most need of improvement.

The WHO glossary describes passive systems as, “Systems which maintain a temperature-controlled environment inside an insulated enclosure, with or without thermostatic regulation, using a finite amount of preconditioned coolant in the form of chilled or frozen gel packs, phase-change materials, dry ice or others.”

In its executive summary of the survey results, Sonoco Thermosafe noted, “The current logistics spend for temperature-sensitive healthcare products is approximately $8.4 billion worldwide and growing, or about 13% of the overall pharmaceutical logistics market. Approximately $5.6 billion is spent on transportation while another $2.8 billion is allocated to specialized packaging and monitoring devices,” attributing the figures to Lipowicz, M and Basta, N., Supply Chain Logistics 2014 Biopharma cold-chain forecast, Pharmaceutical Commerce, April 29, 2014

The 26-question survey was co-developed with an advisory panel of industry professionals from Merck, Sanofi, AbbVie, UPS Temperature True Packaging, IQPC, Exelsius, Healthcare Packaging, and Pharmaceutical Commerce. Of the survey’s 165 respondents, there was a near 60-40 split between drug product manufacturers and the supply side. Survey results are available here.