Global contract service providers are proliferating, yet few brand owners have established truly strategic approaches to engage them. Leading consumer packaged goods (CPG) companies often have hundreds of service providers under contract. But they have no way to know whether standards, processes, specifications, or reporting mechanisms are being effectively managed.

The stakes are high, with consequences for nonconformity ranging from minor quality issues to major recalls and loss of brand value. New research from Packaging & Technology Integrated Solutions (PTIS) and Contract Packaging magazine reveals the contracted services industry is strong and growing (44% of respondents say they will use more contract packagers in the next 12 months), but clearly there is justification for a more strategic approach to procuring contracted services. The survey results, while not scientific, convey in general that more brand owners are about to move in that direction.

A strategic approach can help brand owners meet the packaging challenges inherent in today’s branding and retailing dynamics that, for example, emphasize speed to market, short life cycles, special channel packaging, and frequent stock rotations. These merchandising approaches require shorter product runs in which both the product formula and the package-label text or graphics might change often. The strategic approach might be appropriate when few or no alternate suppliers are available to the brand owner on short notice. Options may be limited because of a need for proprietary equipment or processes or other factors making the initial supplier’s capability unique in its ability to meet a brand owner’s specific needs.

Relationships important

In this type of situation, the buyer should develop a strong supplier relationship in which the contract-packaging vendor is both capable and committed to both a brand owner’s ongoing success and to the longer-term nature of the relationship. The buyer is best-suited to establishing a price with the supplier through negotiations based on a clear understanding of cost and alternatives, as well as the potential for an ongoing business relationship.

The strategic approach contrasts with the more traditional tactical use of contract-packaging services. A tactical approach is best-suited when several alternate suppliers are available that can take on a brand owner’s business should supply be interrupted from a selected vendor. Under these circumstances, the impact is minimal to the product manufacturer if the initial supplier encounters difficulty. The expense encountered in making the change in suppliers—defined as “cost to change”—would be seen as low, time to implement would be within an acceptable duration, and appropriate equipment and capacity would be readily available. Overall supply risk to the business would be deemed manageable. Should your assessment show this approach to be a tactical buy, you would be well-suited in placing your business through a competitive bid or auction. Primary focus would be on delivered price, without significant consideration of future business needs.

Contracting companies should understand clearly both the rewards and risks they assume through either the strategic or tactical approaches, and they should approve procurement differently for each alternative. Effectively turning over the execution of a significant portion of your business processes to an outside firm involves complex considerations, and the contracted firm will play a key role in establishing your product quality and availability, and ultimately, play a vital role in consumer satisfaction with your product.

During the past 20 years, brand owners have added hundreds of contract manufacturers and packagers to their supplier lists in response to market demands. As these lists have grown, purchasing departments have added new capabilities just to manage the identification, qualification, and management of contract providers.

These new developments typically are tactical rather than strategic. A few leading brand owners have taken a truly strategic approach to managing these efforts. However, even the leaders have, in some cases, taken their eye off the total target by reducing short-term costs at the risk of sacrificing control of quality.

Reactive practices of sourcing contract packagers based on a short-term need to push new products to market quickly, or simply finding those with lowest cost, are tactical and not “sustainable.” Should brand owners allow this key business process to be sourced strictly on a low-bid basis, their shortsighted objectives might result in customer dissatisfaction and lost market share. These issues are possible if the contracted partner fails to perform as required over the long run.

The approach to placing contracted services depends largely on your assessment of the business being either tactical or strategic in nature. Primary considerations include the nature of the project, the potential risks involved, the availability of alternate sources, and business objectives and imperatives.

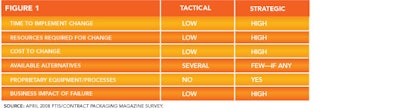

The table in Fig. 1 summarizes some of the primary considerations in determining your company’s sourcing approach and the factors involved in changing from tactical to strategic use of contract-packaging services.

Though your analysis may show that your company’s circumstances do not completely track down one side of the table or the other, you will understand some of the primary considerations necessary to source your business and to establish an appropriate relationship with a co-packer.

Research findings

Results of a survey conducted by PTIS and Contract Packaging magazine show that more CPG companies are embracing a model that makes strategic use of contract-packaging services. In fact, more brand owners will be adopting the strategic method over the next five years, as the charts in Fig. 2 indicate. Currently, 58% of the survey respondents overall describe their approach to procuring contract-packaging services as tactical and 42% are strategic. But 12% of respondents who currently use the tactical approach indicate they will evolve to a strategic method in anywhere from one to five years. These numbers indicate that more product manufacturers are beginning to embrace the value of using contract packaging as a well-planned, sustainable solution rather than a reactive solution to temporary needs.

Nearly 200 professionals from CPG companies across the nation completed the survey in April 2008. Respondents came from across packaging sectors, with 46% from food and beverage, 18% pharmaceutical, and 17% personal care/cosmetics. The remaining 19% were from other product categories and retailers and club stores. Filtering the data another way, 24% of the respondents represented companies with revenues surpassing $1 billion, and 48% were from companies with revenues of less than $100 million. The other 28% of respondents were from companies with revenues between $100 million and $1 billion.

Responses didn’t vary much based on annual revenues (Fig. 3). However, companies with revenues exceeding $1 billion were far more likely to think globally versus nationally or regionally about contracted services. Large CPG companies also were somewhat more likely to be looking for larger contract packagers (Fig. 4). In addition, companies procuring contract-packaging services identified supply chain and logistics, and sustainability, as very important selection criteria. Sustainability factors rated almost as important.

So, additional contract-packaging capacity will be needed, and some CPG companies are seeking larger contract packagers. In addition, strategic capability requirements are broadening to include factors beyond packaging.

The case for outsourcing

Global brand owners are focusing on their core strengths and capabilities and shedding non-core activities. A.G. Lafley, Procter & Gamble CEO, recently projected reducing the manufacturing giant’s work force from 125,000 to 25,000. His plan is feasible only by divesting P&G’s manufacturing operations. Lafley wants the company to focus internally on brand management, marketing, and developing products and technologies through open innovation. At P&G, this process is called “Connect and Develop.” As the company identifies innovation opportunities, it plans to rely more on external sources for solutions. Lafley’s goal is to tap external sources for more than 50% of P&G’s innovation initiatives by 2010, compared with 35% today.

Other leading companies successfully implementing the open-innovation model include DuPont, Intel, Alcatel-Lucent, Merck, IBM, and Dell. The PTIS/Contract Packaging survey data support the conclusion that this movement will not slow in the near future; companies intend to outsource more work to contract packagers and manufacturers.

Furthermore, market forces have pushed CPG companies away from bricks-and-mortar and new, high-volume capital expenditures. These market factors include sales channel fragmentation demands from retailers, consumers demanding product variety and value, shorter product life cycles, and globalization. Third-party contract service providers—both domestic and global—provide critical resources that are offering forward-thinking brand owners efficient and effective speed-to-market capabilities for new products and package formats.

So what’s the problem?

In most cases, when major brand owners start up at a contractor’s site, quality is paramount and is monitored rigidly. However, as these new products exist over time on store shelves, costs and margins eventually tend to take precedence. The number of quality inspectors, processes, and samples is reduced, often justified by a history of control and no reported issues. The biggest issues occur with companies that have been using contractors for many years, rather than those that are new to contract packaging.

Compounding the issue, leading brand owners, pushed by short-term marketplace pressures, have added new contractors by the dozens in a nonstrategic, very reactive manner. So now, instead of controlling a few contract manufacturers, major CPG companies have built entire departments. They are staffed to attempt to manage identification and qualification of hundreds of third-party companies and facilities.

Challenges cited

Because the majority of the survey respondents treat contract packaging as a tactical buy, it is not surprising that they are using rather basic tactical methods of selecting and managing those suppliers. These methods include audits, specifications, and contract terms.

A key concern stressed by companies considering outsourcing is the difficulty and resources required to manage global outsourced manufacturers. Managing an entire supply chain that includes vendors in China or Vietnam, for example, makes it very difficult to receive up-to-date information on production schedules, inventory, and quality status to understand the “true” status of a project. Many brand owners attempt to compensate for these shortcomings by turning to manufacturing outsourcing specialists who specialize in offshore and near-shore supplier development and ongoing management. Rather than simply manage a contract manufacturer’s quality, these specialists use technology to ensure clients receive current and accurate information on the status of all elements of the outsourced business. This information allows clients to make “informed” decisions as soon as possible, either daily or hourly.

Solutions are possible for the issues associated with the strategic use of contract-packaging services. An accompanying sidebar presents some ideas.

The authors, Brian Wagner and Fred Ashenbrenner, are packaging industry veterans. Wagner is co-founder and COO of Packaging & Technology Integrated Solutions and has more than 20 years’ experience at companies including Kellogg’s, Sara Lee, and General Foods. Contact Wagner at [email protected] or 800/875-0912. Ashenbrenner is a senior associate at PTIS who has more than 30 years of procurement and related logistics experience, including 26 years at Kimberly-Clark. Contact Ashenbrenner at [email protected].