High demand for machines in manufacturing sectors ranging from automaking to packaging will push the industrial machinery market to new heights during the next five years, highlighted by a doubling of growth this year, according to a new report from IHS Technology.

As economic conditions continue to improve worldwide, the demand for machines in sectors such as agriculture, packaging, materials handling, and machine tools will push revenues to $1.6 trillion this year, up from $1.5 trillion in 2013. This represents annual growth of 6.3%, more than twice the 2.9% increase seen in 2013.

Strong growth is forecast to continue for the next four years, with revenue rising to $2.0 trillion by 2018. During this period, the machinery market's annual growth rate will average between 5% and 6%.

"The improving economic outlook is a key factor in the strong growth of machinery in the coming years," says Andrew Robertson, Senior Analyst for Industrial Automation at IHS. "The growing populations and the expanding middle classes in developing countries are generating more disposable income. This translates into increased demand across a vast number of sectors."

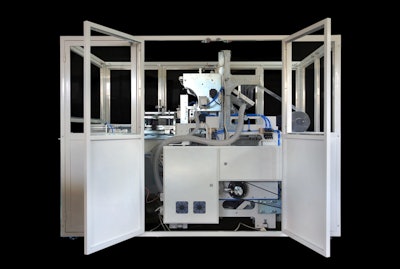

Packaging is a sector that is slated for high growth in the next few years. The increase in packaging market growth will come from an investment in lighter packaging. Such packaging requires less material, generates less waste, is more energy efficient to produce, and offers improved aesthetic appeal.

Lighter packaging options are also suitable for developing countries where processed products are becoming more attainable for a growing middle class.

Furthermore, advances in packaging, such as wrapping food in ready-to-cook enclosures, cartons that are never pierced until opened, and new aseptic packaging technology are promoting demand for industrial machines in this sector.

"Whether for convenience, improved shelf life or better taste, new industrial machines are contributing to the continued growth of the packaging market," Robertson said.

Sales growth for industrial machines in 2014 is being driven by a number of factors.

First, higher demand for cars worldwide is spurring the requirement for more spending on tools and robotics in the automotive business, as well as the rubber and plastics segments. Meanwhile, an increase in the standard of living and growing spending on nutrition will benefit the food and packaging machinery sectors.

Turbulent past

The growth of the machinery market represents a welcome change from just two years ago when not every region performed well. The Americas prospered in 2012, boosted by a significant government investment that caused machinery production revenue to grow by 6.5%. In 2013, machinery production growth in the Americas slowed to 2.0%, but still fared better than some of the other regions.

In the Asia-Pacific region, however, growth slowed to only 3.5%. A majority of this slowdown came from China, where production remained nearly flat because of overcapacity.

Meanwhile, Europe struggled as a result of the economic problems persisting throughout the region, and machinery production revenue declined by 5.6% in 2012, dragging down the entire global market. Europe increased output last year, but only by 1.1%.

IHS provides information, insight, and analytics in critical areas that shape today's business landscape.