Key Takeaways:

· Based on pharmaceutical sales in 2024, four out of the top five pharmaceutical products require refrigeration.

· It’s important to understand intent when it comes to the packaging and the importance of a correct pack out.

· One best practice for receiving a pharmaceutical shipment is to use an electronic sensor such as a digital data logger.

To kick off TempPack at the ISTA Forum last week in Orlando, FL, Chris Anderson, Director, Quality Management at Cardinal Health shared a pharmaceutical industry update. As part of the ISTA Pharma Committee, which is committed to providing education through technical exchange sessions, work groups, ISTA connect, and conferences, he gave the audience, me included, some interesting insights into the state of the industry.

First up, U.S pharmaceutical sales in 2024 totaled $814.7 billion (+9.8%). A whopping 73.3% growth came from volume increases.

· Brands $718.10 billion (+10.7%)

· Generics $55.9 billion (+54.3%)

· Biosimilars $15 billion (+51.8%)

Based on pharmaceutical sales in 2024, four out of the top five pharmaceutical products, based on sales volumes, are GLP-1s, which require refrigeration. Not too surprisingly to hear that GLP-1s, which are a class of medications used to treat type 2 diabetes and obesity, are rising in use here in the U.S. They work by mimicking the natural hormone glucagon-like peptide-1 (GLP-1), which helps regulate blood sugar levels and promote satiety. In 2014, the FDA approved Saxenda (liraglutide) as the first GLP-1 specifically for weight loss. Later, in 2021 Wegovy (semaglutide) received the same indication. Semaglutide was previously available for diabetes as Ozempic and in an oral form for diabetes as Rybelsus. Between 2018 and 2023, prescriptions for these drugs increased by a staggering 300%, according to “2023 Trends Shaping the Health Economy,” a report by trilliant health.

Second, Anderson shared that mail order for drugs are on the rise. The U.S. mail order market is valued at $230.2 billion (28.4% of U.S. pharma sales) and the top five U.S. mail order drugs are as follows:

· Humira $21.2 billion

· Stelara $13.6 billion

· Skyrizi $13,.4

· Dupivent $12.8

· Enbrel $8.2

Again, four out of these five drugs require refrigeration. This of course, has a huge impact on distribution and points to the increased need for safe and effective temperature-controlled shipping and receiving. To offer some insights into that, Liana Montemor from Grupo Polar shared best practices for receiving pharmaceutical shipments, which include:

1. Open the box in a temperature-controlled area that matches the temperature of the product inside (receiving area must be thermally qualified).

2. Don’t just test some of the product, 100% of product must be checked for proper temperature.

3. Do not use an infrared thermometer as they do not meet metrological requirements for accuracy and resolution.

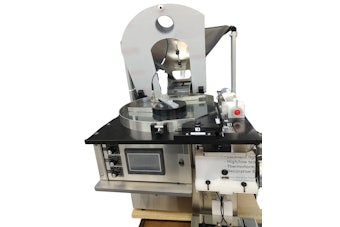

4. Use an electronic sensor such as a digital data logger with a probe or thermocouple.

In the pharmaceutical industry, data loggers are essential for ensuring product quality and safety by monitoring temperature, humidity, and other critical parameters during storage, transportation, and manufacturing, helping to maintain compliance with regulations like GxP.

Understanding data loggers, how they work, and then making sense of the data is key to success. In an end-user panel session, Sally Egger from Sarepta Therapeutics and Craig Vermeyen from Kite discussed the importance of understanding intent when it comes to the packaging, the need for proper training, and the importance of a correct pack out. There was also discussion on taking a risk-based approach by pondering, ‘what factors should we consider to prevent damage? What corrections should be made?’

The parting knowledge was that real-time data is important and is considered a best practice in mitigating risk. Vermeyen suggests that pharma manufacturers get more agreements in place with vendors to get more of their data and of course have an understating and the rights tools in place to use that data effectively.