At first glance, serialization sounds like a nearly impossible task for Johnson & Johnson. Not only does the New Brunswick, NJ-based company’s global project involve thousands of products, but it also necessitates meeting challenging worldwide regulations, including FDA’s Drug Supply Chain Security Act (DSCSA) and the European Union’s Falsified Medicines Directive (FMD).

Johnson & Johnson’s “Credo” places the needs and well-being of the people it serves first. Meeting that patient priority includes serialization, track and trace, anti-counterfeiting and brand authentication efforts. So too do the approximately 63,000 professionals working worldwide within the Johnson & Johnson Supply Chain (JJSC).

“We have several thousand J&J products impacted by serialization. These are global, including products in the U.S., EU, China, Brazil, the Mideast, Korea and Saudi Arabia, where we meet all their serialization requirements,” notes Mike Rose, J&J VP and a specialist in supply chain visibility, traceability and product identification.

Prescription products requiring serialized packaging include drugs that treat immunology, cardiovascular and metabolic disease, pulmonary hypertension, infectious disease and vaccines, neuroscience and oncology. These medicines are manufactured, marketed, and distributed by the Janssen Pharmaceutical Companies of Johnson & Johnson.

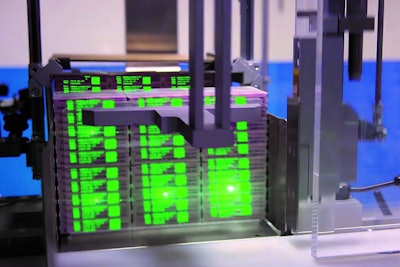

J&J products are sold in virtually all package types, including bottles, vials, syringes, pens, bags, pouches, blister packs, cartons, etc. Equipment-wise, the “heavy lifting” machinery used most often to achieve serialization are printers, coders, labelers, inspecting/visualization equipment, cartoners, cameras, software, artwork and automated controls/IT systems.

The company prefers not to divulge suppliers for the equipment or IT systems, although Rose reveals, “We work with two suppliers that provide us with control software and all necessary packaging equipment, including visualization machinery. These aren’t system integrators. By having two primary suppliers we have a more manageable process that gives us flexibility, yet still provides redundancy in terms of having more than a single supplier.”

‘Phased-in’ approach

Rose explains, “We have teams that meet regularly to determine when and how best to phase-in a particular packaging line. We carefully consider global and regulatory updates for specific markets to make certain we understand compliance issues.”

To do that, says Rose, “we use GS1 to create serialization license plates, using 2D matrix codes. We implement GTIN codes into our identification license plate, which includes our serial numbers, expiration dates, batch numbers and country-specific information like reimbursement codes. So, while there may not be global harmonization, these license plates can look the same in various countries. The differences are usually in the specific data within the license plates for a country code. For example, there is a CIP code in France.”

Economics and ROI

Rose explains that J&J implemented serialization and aggregation functions simultaneously in the U.S. and in Brazil, but not for compliance with the EU Falsified Medicines Directive. “There is an additional layer of complexity and cost in adding aggregation, so if we would have done that in Europe we wouldn’t have been able to meet regulatory deadlines,” he explains. “But there are economic advantages in going in at once and completing both the serialization and aggregation steps in the U.S.”

He admits that when the company embarked on its serialization efforts and adding the necessary packaging equipment, “we did experience a dip in Overall Equipment Effectiveness (OEE). The process adds at least one, and possibly multiple steps. But after our personnel began to become used to the process, our OEE began to climb back up to within 2% to 3% of where it was before the implementation.”

Beyond determining packaging line OEE impact, Rose says J&J sees areas of opportunity as a result of serialization and track-and-trace investments. For example, he explains, “when products are scanned there can be information shared between the consumer, the supplier and the retailer. The European FMD provides information that can benefit us in terms of pharmacovigilance, pricing and reimbursement issues. So, while the overarching goal for serialization is to drive out counterfeits, there are healthcare benefits to the information we can use internally, and to help with patient outcomes.”

Observations and future expectations

Of course, J&J is also a major player in the medical device world, an area in which some equate Unique Device Identification to serialization in the pharmaceutical space. Rose has a different perspective: “We see UDI as different from serialization. The term unique would be better replaced by the word uniform. I think unique causes some confusion because it sounds like it’s serialization or creating a unique number.”

Big-picture wise, Rose says J&J believes that serialization and track and trace represent one layer of protection in a multi-layer process that should include overt and covert processes, an approach that’s encouraged by the U.S. government (see sidebar). “In the EU FMD,” he points out, “they employ 2D data matrix and tamper-evidence functions.”

So, with the DSCSA’s November 26, 2018 product identifier enforcement deadline quickly approaching, where does Rose envision serialization headed? “I think in the future, 2D data matrix codes could work in concert with QR codes and provide more information, web links, etc. We looked into RFID years ago, but not everyone can read those chips. Barcodes work well at point of use and barcode readers are in common use. RFID could someday work for high-value products, or maybe in cold chain applications. I also believe the Internet of Things for pharmaceuticals will be a big benefit moving forward.”