Companies in this article

Is a 'tipping point' near for unit-dose prescription packaging?

Walmart and other pharmacies could push the use of unit-dose packaging in the U.S., says Peter G. Mayberry, executive director of the Healthcare Compliance Packaging Council.

Mar 29, 2009

Start 2026 with Smarter Packaging for Life Sciences at PACK EXPO East!

Be the first to find what’s next in packaging for life sciences at PACK EXPO East. See solutions from 500 exhibitors, gain inspiration in free educational sessions and uncover new ideas for your industry and beyond—all in one trip to Philadelphia.

REGISTER NOW & SAVE

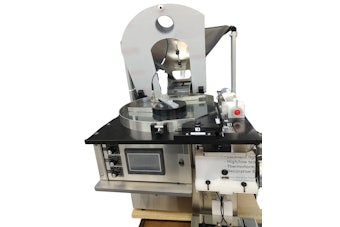

Researched List: Blister Machines for Life Sciences

Need a blister machine for life sciences packaging? Our curated list features companies serving pharmaceutical, medical device, nutraceutical, and cosmetic industries. Download to access company names, locations, machine specifications, descriptions, and more.

Download Now

Downloads