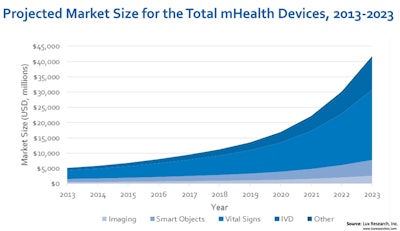

Driven by adoption of vital signs monitoring and in-vitro diagnostic (IVD) devices, the mobile health (mHealth) market will grow eight-fold from $5.1 billion in 2013 to $41.8 billion in 2023, according to Lux Research.

Lux Research says mHealth devices combine existing consumer electronics devices with application-specific sensors and specialized algorithms to create personal devices used by patients, medical professionals, and consumers to improve personal health.

Examples of mHealth devices, according to Lux Research:

• Fitness and activity trackers—e.g. FitBit Flex, Misfit Shine, Sensoria Smart Sock/Anklet (by Heapsylon)

• Consumer electronics device-based in vitro diagnostic (IVD) and imaging devices—e.g. Sanofi’s iBGStar, i-calQ, Mobisante

• Wearable vital signs monitoring devices—e.g. Sotera Wireless, BodyMedia FIT, Biovotion

Clinical mHealth devices will soar past consumer-focused counterparts after a slow start due to regulatory approval barriers and slower integration into physicians’ workflows. For instance, clinical vital signs monitoring devices will grow from $372 million in 2013 to $16 billion in 2023, a compound annual growth rate (CAGR) of 46%, while consumer applications will grow from $2.5 billion to $7 billion, an 11% CAGR.

“Consumer devices have seen a lot of hype but clinical devices will surpass their consumer counterparts in revenues by 2020, helped by value-added software services and generally larger revenue streams,” says Nick Kurkjy, Lux Research Associate and lead author of the report titled, “mHealth Showdown: Consumer and Clinical Devices’ Battle for Market Dominance.”

“Clinical markets will be able to pay much more for comparable services, especially if a device is able to reduce patient recovery times or readmission rates, which can lead to outsized cost savings for the health care provider,” he adds.

Lux Research analysts explored progress of the mHealth industry to understand where the opportunities lie. Among their findings:

• Smartphone boom leads to increased mHeatlh VC funding. Venture funding for mHealth devices has risen sharply since 2007, reaching $480 million in 2013, driven by the launch of the iPhone and growing popularity of the smartphone.

• IVD and vital signs spaces make up 75% of the mHealth device market by 2023. The considerable growth of the mHealth device market will be largely driven by the vital signs and IVD sectors. Lux Research projects that these two will combine to make a $32.9 billion market by 2023.

• Vertical integration is coming. Large players from both electronics and medical device industries are starting to make acquisitions. Covidien’s purchase of Zephyr Technologies and Intel’s acquisition of Basis are among the most recent moves, as major companies look to stake their claims.

The report, titled “mHealth Showdown: Consumer and Clinical Devices’ Battle for Market Dominance,” is part of the Lux Research BioElectronics Intelligence service. Lux Research provides strategic advice and ongoing intelligence for emerging technologies.