A successful patient outcome relies in no small part on packaging reliably delivering medications where needed, making the meds easy to use, and providing clear and concise instruction booklets and all-inclusive kits, particularly for at-home use, seen as a positive trend in that it offers some balance to the higher cost of specialty drugs (see "8 parameters of specialty drugs below) while reducing and/or shortening hospital stays.

A takeaway from Xavier University’s PharmaLink conference was that insurance is a for-profit business, but delivering the best outcome for the patient is the goal, said Humana’s Fran Gregory. The challenge is arriving at this best outcome at the lowest cost.

Gregory said Humana is focusing on the evolving “retailization” of healthcare, and exploring both the opportunities and the challenges.

As recently as 10 years ago the vast majority of Americans were insured by their employer. By 2017, depending on the strength of the economy, up to 44% of us will be accessing healthcare on an individual level.

Insurance likes a great drug that does the job. Humana wants to keep covering those drugs. And certainly no drug maker wants to make a drug no insurance company is willing to cover.

The old model is a patient-disconnected, accessing healthcare on an episodic basis. Today’s consumers are plugged in and proactive, seeking wellness.

When shopping for coverage, you might assume choices like “that Doctor is in my network, or my hospital is covered” would steer purchase decisions. But actually, “Is my medication covered?” is the primary deciding question that factors into the choice.

An enlightened public is good news for insurance companies, yet not so good for brand owners who are seeing a steep decrease in use and subsequent insurance spending for brand-name drugs, according to Gregory.

Also good news for Humana is a slight uptick in the use of generics, [which are considered] more affordable and widely available, although there have been some alarming generic price hikes recently. Generic price inflation is an unexpected and unwelcome trend that is extremely concerning, said Gregory. The top offenders have high utilization rates, compounding the impact.

More challenging is the extremely rapid growth of specialty drugs (mostly bio-tech), a trend that is increasing and forecasted to continue. Of the 278 billion spent on drugs, $63 billion is spent on specialty drugs.

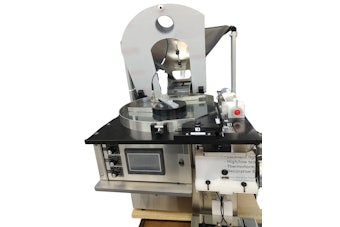

These drugs tend to require deeper patient participation, more education, and they present unique shipping and packaging challenges. Bio-tech drugs are inherently less stable and subject to vibration and temperature excursions that may compromise efficacy. Due to their high cost of production, you will not see multiple plants in multiple countries. These less-stable drugs are going to have to survive transportation challenges and arrive in ideal condition.

Only 2% of patients use specialty drugs, but these patients comprise 15% to 20% of drug costs.

The percentage of the population requiring these drugs is predicted to remain stable, at 3% to 5%, but costs could eventually account for 50% of insurance spending. So you are moving toward a model where 95% of the insured population is covering the 5% of patients requiring specialty drugs.

How does Humana continue to pay for these drugs? And how do they keep rates competitive for the other 95% without penalizing the small percentage of patients who require more costly medications?

Typically, these patients do pay higher out-of-pocket premiums, and manufacturers often do subsidize the cost.

But the landscape is forever changed. Direct-to-consumer advertising includes mass messaging for rare autoimmune diseases. But the commercials cause people to call their doctor.

So the question becomes, how do we know these drugs are delivering on their clinical promise once they get in the field? Adherence rates for specialty drugs are extremely high, estimated at nearly 80% to 90%.

But if one regimen of a cancer drug is $13,000 a month and gets approved, but the prescription is never refilled, was that the right drug? Was it the right patient?

Humana would rather see [a prescription for?] five or six months, despite costs, because there is a greater chance the drug will actually work and the patient will have a positive outcome.

And if Humana decides not to cover a particular cancer drug, even if the evidence is there that it is not very successful, this could be highly controversial.

8 parameters of specialty drugs

• High cost

• Require special handling

• Treats rare disease

• Available on a limited basis/limited distribution

• Requires ongoing assessment of patient response

• Requires patient, family, and healthcare worker training

• Side effects must be more closely monitored

• FDA mandated REMS (Risk Evaluation and Mitigation Strategy) In 2007, the FDA gained the authority to require REMS, requiring manufacturers to ensure that the benefits of this drug will outweigh its risks. Oncology drugs, highly toxic, are the leading type of specialty drug.