Key Takeaways:

· The U.S. healthcare contract development and manufacturing organization market is expected to grow 9.41% from 2025 to 2033.

· The pharmaceutical segment dominates the U.S. healthcare contract development and manufacturing organization market.

· Market growth is driven by rising demand for biologics, biosimilars, and advanced therapies, including cell and gene therapies.

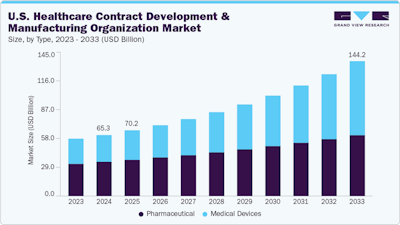

The U.S. healthcare contract development and manufacturing organization (CDMO) market is on a remarkable growth trajectory. Valued at $65.3 billion in 2024, the industry is projected to more than double, reaching $144.2 billion by 2033, according to Grand View Research. This surge—driven by a 9.41% compound annual growth rate—is reshaping how drugs and medical devices move from concept to patient care.

So what’s fueling this momentum? A perfect storm of rising demand for biologics, biosimilars, and cutting-edge therapies—like cell and gene treatments—combined with intensified R&D efforts in oncology, rare diseases, and immunology. By 2024, small molecules claimed the largest market share by type, pharmaceuticals led by product category, contract manufacturing dominated by service, and commercial-scale operations took the lead in workflow.

Why CDMOs matter more than ever

Once considered outsourcing partners, CDMOs are now strategic linchpins for pharmaceutical and biotech companies. They provide the infrastructure, scalability, and technical know-how that many organizations can’t—or don’t want to—build in-house. With biologic patent expirations, expanding drug pipelines, and the rise of personalized medicine, the need for speed and efficiency has never been greater. By leveraging CDMOs, companies can cut costs, accelerate development, and navigate complex compliance landscapes without the staggering capital investments and workforce demands of in-house facilities.

CDMOs also bring something else to the table: regulatory knowledge and expertise. Operating within the FDA’s stringent frameworks, they deliver robust quality systems, deep expertise in global submissions, and now, data-driven compliance systems. These companies usually have expertise in digitalization, automation, and advanced oversight tools that some pharma and medical device companies may lack.

What’s driving growth

Beyond regulatory and financial efficiency, the CDMO sector is thriving on industry shifts. The explosive rise of biologics, cell and gene therapies, and mRNA-based treatments demands specialized infrastructure—an area where CDMOs excel. Emerging biotech startups, many without in-house capabilities, are fueling outsourcing activity, while established pharma players increasingly rely on flexible models like modular, multi-product, and continuous production systems.

At the same time, the digital revolution is reshaping the manufacturing floor. AI, automation, and advanced analytics are streamlining operations, predicting outcomes, and enabling smarter, faster decision-making. Robotics and single-use bioprocessing systems are further enhancing flexibility, lowering contamination risks, and reducing costs—essential for multi-product facilities and smaller batch runs. Collectively, these innovations position CDMOs as indispensable partners in advancing next-generation therapies.

Challenges and opportunities

Of course, growth doesn’t come without challenges. U.S. tariffs on raw materials, APIs, excipients, and specialized equipment have driven up costs, squeezed margins, and disrupted supply chains. Yet, paradoxically, tariffs are also creating opportunities for domestic CDMOs as pharma companies look to reduce reliance on overseas facilities. This shift toward localized manufacturing could further cement the role of U.S.-based CDMOs in global supply strategies.

Looking at the segments

Pharmaceutical outsourcing remains the cornerstone of the CDMO market, commanding the largest share in 2024. Companies rely on CDMOs for everything from drug discovery support to lifecycle management, driven by the need for cost efficiency, scalability, and compliance. The rise of generics, complex formulations, and high-potency APIs only accelerates this trend.

Meanwhile, medical devices represent an emerging growth engine. With rising regulatory complexity and demand for rapid innovation, device manufacturers are increasingly outsourcing design, development, and production. Advances in minimally invasive technologies, diagnostics, and drug-device combination products are opening new opportunities for CDMOs with expertise in prototyping, precision engineering, and compliance with FDA standards. Coupled with an aging population and rising chronic disease burden, this segment is poised for significant expansion.

The big picture

Taken together, these forces position CDMOs not just as support players, but as critical drivers of U.S. healthcare innovation. By balancing compliance, cost-efficiency, and cutting-edge technology, they’re helping to bring life-changing therapies to patients faster—and shaping the future of the industry itself.