To these engineers, newer controls like programmable limit switches and control language are areas they need to learn about.

These were among the primary findings of a comprehensive survey of Packaging World readers conducted this spring. With the help of Market Research Support Services (Itasca, IL), PW asked a select group of production and engineering people about the components they recommend, specify or purchase for packaging equipment, and how knowledgeable they are about these components. This report, and Part II to be published next month, summarizes the results from 135 completed questionnaires.

Of the 135 readers who responded, over 85% report that they buy or specify packaging equipment as part of their responsibilities. Just 20 respondents say they don't specify or authorize the purchase of machinery. Meanwhile, an impressive 63.7% also say they buy or specify replacement parts for packaging equipment. This was somewhat unexpected, since replacement parts are often the purview of maintenance mechanics in larger companies.

And the readers participating in the survey came from a broad cross-section of companies, from the majors like Anheuser-Busch, Eastman Kodak and Procter & Gamble, to smaller manufacturers like Barber Foods, Marquette Electronics and Chilton Malting. Survey participants bore titles ranging from Vice President of Operations to Project Leader to Production Superintendent.

Do people move about in packaging? We found significant evidence to support that. About 90 days after we received the questionnaires, we recontacted some of the participants by phone, only to find that they had been promoted, while others had already left the companies they worked for only three months earlier. In fact, the respondent first picked as the winner of an incentive prize for completing the survey had already switched jobs when PW called about the prize.

Specifying components

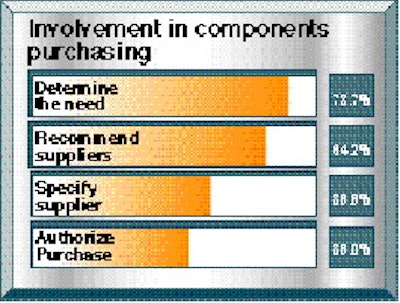

Since all the respondents indicated that they participated in the selection if not the specification of components to packaging equipment, the survey sought to quantify their involvement in purchasing components.

With the assistance of research consultant MRSS, respondents were asked to detail their roles among four common steps in purchasing (Chart 1). Because many, if not most, participate at more than one level, there were many compound answers.

Nearly 74% of participants say they help to determine the need for purchasing components. Over 62% say they have input in recommending suppliers of the components to be bought. Just under 40% of all respondents report they actually specify the supplier, and nearly the same percentage of respondents (39.1%) say they have authority to make the purchase. It's obvious that the respondents to the PW survey represent true buying influences who are heavily involved in the selection of packaging components for their companies.

Of all respondents, about 27% reported that they don't actually specify the components their companies buy for packaging equipment. Of the 72% of participants who do specify, the survey sought more detailed information.

Mechanicals lead the way

The survey identified 10 types of components and asked which of them the respondents might specify. The answers were decidedly skewed toward the more common and more mechanical components (Chart 2). Like elsewhere in the survey, multiple answers were the norm as few participants were involved with only a single component.

This response may be typical throughout packaging. But it also may have been due to our skewing of those who participated in the survey. PW and MRSS consciously selected a list that balanced readers from large companies with an equal number of those from smaller companies. About half the list were individuals from companies with 1ꯠ or more employees, the other half from companies with 50 to 100 employees.

Obviously, the larger companies simply buy more components of all kinds because they have far more packaging machines than smaller companies. However, smaller companies are far more numerous than the big firms. So PW felt it was important to recognize this dichotomy in our survey results. Thus every response from one of Anheuser-Busch's highly automated breweries, for example, is equivalent to a response from one of the small companies we surveyed.

The components most common to our specifiers were coding/marking machines and conveyors with 80% and 78.9% respectively reporting they were involved in buying them. Motors/drives finished third in the survey, with 67.4% of respondents saying they purchased them.

Doubtless, some of our readers will object to coding and marking machines being termed as a "component." After all, the sophistication, performance and sometimes the cost of these machines today can rival that of many stand-alone machines. A similar argument can also be made for conveyors. For this survey, however, coding/marking refers to the type of marking and coding machines that might be typically added on to a bagging machine or to a case sealer.

Ironically, the surveying was completed about the same time that many major brewers and soft drink companies were explaining freshness. Many were adding marking equipment to their packaging lines to apply "best if consumed by" dates, or in the case of Anheuser-Busch, the "birth dates" of each container of beer (see Packaging World, Aug. '96, p. 4).

Increasing complexity

The next group of components were specified by about half the participants. Leading the way were pneumatics at 56.8%, followed by sensors at 53.7% and sealing heads at 47.4%. In all, the six selections that were most often specified represented all the traditional functional add-on or replacement parts.

This distinguishes them from the most common replacement parts like relays and switches and belts that mechanics use to keep equipment running. Another factor that separates them from most simple replacements is their upgradability. New designs in pneumatic cylinders, different types and sensitivities of sensors and new materials used in creating sealing systems all may offer new enhancements in performance, durability and function.

Upgradability is even more significant in the four types of electronics-based components the survey asked about. Four in 10 respondents said they specified either programmable controllers or programmable logic controls. A bit over one quarter say they're involved in buying machine vision systems.

It seems that the final two types of "components," the control language and programmable limit switches, scored low, perhaps for different reasons. Except in smaller companies, the control language used to program PLCs, which in turn govern most of today's packaging machines or even whole packaging lines, is often decided by corporate engineers so it will be compatible with other lines, maybe even other plants. That may be why only 12.6% of respondents were involved in buying them.

The acronym PLS for the programmable limit switch, however, may not yet be in common usage. They are typically specified by plant personnel. Yet only 9.5% of survey participants said they buy them.

Importance echoes

From the same list of 10 categories of components, the survey asked participants to rank the five most important ones they buy. With only a few exceptions, the ranking of importance closely mirrors the descending order of components that are specified. Like the "buy" question, control language and PLSs barely warranted a blip in this ranking, scoring only 3.5% each.

In terms of importance, conveyors slightly outpolled coding/marking machines, 76.5% to 69.4%. Motors and drives remained solidly in third place, logging 61.2%. While pneumatics and sensors again ranked fourth and fifth, controllers jumped into sixth position with 32.9% on the importance scale. Sealing heads were close behind at 29.4%, and machine vision was ranked important by only 17.6%.

The final correlation was made when the survey asked respondents how much they understood about these categories of components (Chart 3). Coding/marking, conveyors and motors and drives were the components that respondents said they knew most about, while PLSs, control language and machine vision were at the other end of the scale.

When we also asked which categories participants knew least about, the order was, expectedly, virtually the opposite. The only real exception is that 6.3% admitted they knew least about conveyors, and about double the percentage said the same about coding/marking and about motors and drives. That would seem to indicate that there are more technology improvements in motors and drives and in coding and marking equipment than respondents perceive occurring in conveyors.

Standardizing vital

Even more so than machinery itself, the standardizing of components was deemed to be vital by most survey respondents (Charts 4, 5 & 6). The survey asked engineers to rate the importance of component standardization to a packaging line, a plant and to a company as a whole. Although the survey used a scale of one to five, the top two and bottom two answers have been combined in our charts.

Standardization of components is considered vital to a packaging line by nearly three of four respondents. By contrast, just about one in 10 said standardization was not important in a line. On a plant-wide basis, component standardization was considered very important by 61.5%, and not important by only 5.2%. Actually one participant in every three was undecided about how important standardizing of components is to a full production plant.

Naturally, the numbers fell further when the survey asked about component standardization across a complete company. While more than 40% still felt it was important, even more (43.6%) were undecided. Some 15.8% were convinced that standardization was unimportant to a company.

Specifying an integrated line

Following up on standardization of components, the survey asked participants to focus on an integrated packaging line within their plant. It then asked about types of components they would specify for a packaging line that combined various types of machines (Chart 7).

Far and away, the most common selection among six was a single make of controller for the line. Nearly two-thirds of the participants favored that. Hand in hand with common controllers would be a single programming language, but fewer than half (47.9%) said it would be specified. About half (49.3%) indicated they specified video display panels for integrated packaging lines.

Despite the strong showing for display terminals, just 35.6% said they typically would buy the self-diagnostic aids often offered with terminals for this multi-machine line. More than four in 10 said they would require data collection from an integrated line, and nearly the same number (38.4%) would specify statistical process control instruments for the line.

In the second part of this report, our survey will focus on electronic components, and reveal which individuals write packaging operations software, who handles machine logic problems and what workers especially need to understand electronic controls. We'll also reveal where engineers obtain information about components, and how valuable these sources are to them.