In 2011, Dansensor recorded sales of approximately $19.3 million.

The acquisition agreement contains customary closing conditions, and MOCON expects the closing to occur on or about April 2, 2012. Under the terms of the acquisition agreement, MOCON will pay an aggregate amount of approximately $20,000,000, two-thirds of which will be paid in cash at closing, and the remainder of which will be paid over four years pursuant to a seller note.

Although MOCON cannot finalize the purchase price allocation until the closing and thus cannot yet assess the exact expected impact on its 2012 GAAP earnings, MOCON anticipates that the transaction will be slightly dilutive to its GAAP earnings in 2012 due to, among other things, the expected level of transaction-related charges. The transaction is expected to be accretive to EPS on a GAAP basis in 2013 and thereafter.

“PBI-Dansensor is a company that we have been interested in for a long time,” commented Robert L. Demorest, MOCON's Chairman, President, and CEO. “Their MAP product line dovetails nicely with our offerings, andtheir international distributor channels will enable many of MOCON's new products to flow to major markets around the world without the necessity of setting up these distribution networks ourselves. Our two companies are very synergistic and an excellent fit with each other. Combining our two companies will allow us to be a strong competitor in the overall MAP marketplace, with many successful offerings to the large customer base of our two companies, as well as to the expected growth in this sector around the world. The acquisition will give us a 2011 combined revenue base of $56.7 million. We are excited to be a part of a company that is now well situated to take advantage of this growing marketplace with a full slate of product offerings.”

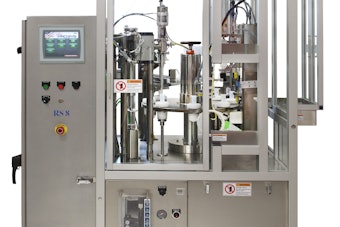

Dansensor designs, manufactures, sells, and services quality control and assurance equipment for businesses that utilize modified atmosphere packaging. Dansensor offers a complete range of gas mixers, analyzers, and leak detection equipment. Dansensor sells its products worldwide and the acquisition will significantly expand MOCON's presence in Europe and particularly in the MAP technology market, a worldwide growing market. MAP has long been utilized to safely extend the shelf-life of these products by reducing the negative effects of oxidation, microbial growth, changes in color, taste, flavor and aroma without the use of artificial preservatives and other un-natural methods.

By acquiring Dansensor, MOCON will supplement its Package Testing line of products. Dansensor's line of gas mixers fills a current gap in MOCON's product line, while Dansensor's line of on-line and off-line headspace analyzers and controls, and on-line and off-line package leak detectors, will add to MOCON's existing product offerings. Their on-line headspace analyzers are considered to be the market leader globally. The unique technologies of both companies, combined with MOCON's strong portfolio of intellectual property holdings, will contribute to the continuation of the state-of-the-art, leading edge products currently available from both companies.

Historically, most of MOCON's sales of Package Testing products have been inside the US, while the majority of Dansensor's have been outside of the US. The mix of products and market channels is complementary, and will lead to an excellent fit for the two companies.

To help finance the acquisition, MOCON has obtained a commitment letter from Wells Fargo Bank, N.A. for a combination of a secured revolving credit line and term debt totaling $8.5 million. MOCON does not anticipate that the transaction, or the financing through Wells Fargo, will negatively impact its ability to continue to pay quarterly dividends.

The acquisition agreement contains customary closing conditions, and MOCON expects the closing to occur on or about April 2, 2012. Under the terms of the acquisition agreement, MOCON will pay an aggregate amount of approximately $20,000,000, two-thirds of which will be paid in cash at closing, and the remainder of which will be paid over four years pursuant to a seller note.

Although MOCON cannot finalize the purchase price allocation until the closing and thus cannot yet assess the exact expected impact on its 2012 GAAP earnings, MOCON anticipates that the transaction will be slightly dilutive to its GAAP earnings in 2012 due to, among other things, the expected level of transaction-related charges. The transaction is expected to be accretive to EPS on a GAAP basis in 2013 and thereafter.

“PBI-Dansensor is a company that we have been interested in for a long time,” commented Robert L. Demorest, MOCON's Chairman, President, and CEO. “Their MAP product line dovetails nicely with our offerings, andtheir international distributor channels will enable many of MOCON's new products to flow to major markets around the world without the necessity of setting up these distribution networks ourselves. Our two companies are very synergistic and an excellent fit with each other. Combining our two companies will allow us to be a strong competitor in the overall MAP marketplace, with many successful offerings to the large customer base of our two companies, as well as to the expected growth in this sector around the world. The acquisition will give us a 2011 combined revenue base of $56.7 million. We are excited to be a part of a company that is now well situated to take advantage of this growing marketplace with a full slate of product offerings.”

Dansensor designs, manufactures, sells, and services quality control and assurance equipment for businesses that utilize modified atmosphere packaging. Dansensor offers a complete range of gas mixers, analyzers, and leak detection equipment. Dansensor sells its products worldwide and the acquisition will significantly expand MOCON's presence in Europe and particularly in the MAP technology market, a worldwide growing market. MAP has long been utilized to safely extend the shelf-life of these products by reducing the negative effects of oxidation, microbial growth, changes in color, taste, flavor and aroma without the use of artificial preservatives and other un-natural methods.

By acquiring Dansensor, MOCON will supplement its Package Testing line of products. Dansensor's line of gas mixers fills a current gap in MOCON's product line, while Dansensor's line of on-line and off-line headspace analyzers and controls, and on-line and off-line package leak detectors, will add to MOCON's existing product offerings. Their on-line headspace analyzers are considered to be the market leader globally. The unique technologies of both companies, combined with MOCON's strong portfolio of intellectual property holdings, will contribute to the continuation of the state-of-the-art, leading edge products currently available from both companies.

Historically, most of MOCON's sales of Package Testing products have been inside the US, while the majority of Dansensor's have been outside of the US. The mix of products and market channels is complementary, and will lead to an excellent fit for the two companies.

To help finance the acquisition, MOCON has obtained a commitment letter from Wells Fargo Bank, N.A. for a combination of a secured revolving credit line and term debt totaling $8.5 million. MOCON does not anticipate that the transaction, or the financing through Wells Fargo, will negatively impact its ability to continue to pay quarterly dividends.

Companies in this press-release