Are Western packagers different from their counterparts east of the Rockies? The best answer is "Yes," but probably only by degree. That's the conclusion of an exclusive survey of packaging executives at 128 different locations in Texas and 10 other states west of the Rocky Mountains, conducted this summer by Packaging World.

The Western results were compared to similar research conducted in the Midwest last year just ahead of Pack Expo 94. Western packagers closely parallel their Midwest counterparts when it comes to the types of equipment they show interest in or intend to buy, principally labelers, coding & marking equipment and wrapping machines.

There were some marked differences in their approaches to many of the same issues we quizzed Midwesterners about last year. However, the passage of a year may be more responsible for the differences than geography. Like the year-ago study, PW worked with Market Research Support Services, Roselle, IL, to devise the questionnaire and tabulate the results.

Purchasing plans

Western packagers show strong interest in-and buying plans for-the same types of equipment their Midwestern counterparts favored a year ago (Chart 1). Interest was most often shown for labelers, new materials and containers, and coding and imprinting machines.

When asked which types of equipment were actually in their buying plans for this year and next, the list was similar but not identical. Labelers were most often mentioned (44.1%), but wrapping equipment tied new materials and containers for second place (30.9%). In fact, one category actually showed a higher percentage of purchase intent than general interest. That was controls and components.

Two other categories, case sealers and filling & feeding equipment, showed a very narrow spread between general interest and plans to buy. Equipment for cartoning, form/fill/seal equipment and inspection devices displayed the widest range between the percentages of those with interest and those who planned to buy the equipment.

Of the categories most often selected, wrapping and shrink wrapping equipment showed the closest relationship between interest and plans to buy. Nearly 39% of Western packagers showed interest in this equipment, and 31% said they planned it either this year or next.

Equivalent budgets

Much like our Pack Expo 94 study (see PW, Oct. '94, p. 72), we asked our Western readers about their budgets for the equipment they planned to buy. For those who said they planned to buy labeling equipment, 42.3% indicated their budget at $13ꯠ or less. Almost another third said their companies would invest between $13ꯠ and $50ꯠ on labeling equipment.

The investment levels were similar for coding and marking equipment. About 39% expected to spend under $13ꯠ, while only 22.2% indicated expenditures would surpass $50ꯠ. Wrapping equipment budgets were similarly modest. Over 83% of those who planned to purchase said their budgets were $50ꯠ or less. And fully half of all those who planned to buy this equipment expected to spend $13ꯠ or less.

At the other end of the spectrum, 70% of those with plans to buy palletizing or depalletizing equipment had budgets over $50ꯠ. Some 78% of those who planned to buy cartoning equipment expected to invest more than $13ꯠ.

Although fewer respondents actually specified their company's budget levels compared to the number who indicated buying plans, investment levels are included as a sort of "qualifier" question to check the validity of responses. If, for example, a high percentage of those who planned to buy form/fill/seal equipment indicated low budgeted amounts, that would be a strong reason to question the data.

Does location affect buying?

PW also inquired whether packagers in the West felt their location had a noticeable effect on their purchasing of equipment and materials. Slightly over half of the respondents (52.6%) (Chart 2) said their location didn't matter, when given a choice of three other answers.

Not surprisingly, a bit more than a third indicated that they do more business with Western-based vendors. Their location, said 9%, meant they work more with consultants than if they were located farther east. Another 4.5% said their location required them to furnish more in-house engineering.

Given the number of natural disasters encountered in Western states over the last few years, PW asked whether these occurences had affected their businesses. Slightly more than 76% said these had no effect. Almost 16% reported these disasters had caused interruptions in shipping schedules, while another 15% said that these events had interrupted deliveries from vendors.

Finally, almost 9% of respondents said their companies had experienced interruptions of plant operations caused by earthquakes, floods and other disasters. These answers add up to more than 100% because some respondents checked more than one answer.

The survey also inquired about the use of copackers and repackers, although the question wasn't specifically linked to disasters. Nearly 70% of respondents said their companies don't use outside companies for packing or repacking. Of those that do, just over 20% report using them more often in '95 compared to last year. Fewer than 6% said their companies are using these services less frequently this year.

Evaluating issues

The survey asked Western packagers to rate a variety of packaging issues on a scale of high interest to no interest. To chart high vs low interest, we combined the two highest answers and contrasted it with the two lowest answers. Between these four answers were three levels of moderate interest that are not considered in the graphic (Chart 3).

The engineers made their presence felt. The two highest-interest issues were changeover time and increasing automation (each 54.3%). These were followed by new materials (48.3%), the addition of bar codes to packages (47.5%) and equipment flexibility (47%).

Conversely, just 5.8% reported little interest in new materials, and 6.5% reported little interest in increasing automation. To check validity, we asked about interest in decreasing product variety. Some 20% of the answers were the two highest, while more than 25% answered at the two lowest levels.

Among the two environmental issues, source reduction produced higher levels of interest (41.1%) than did using recycled materials (35.4%). For virtually every one of the nine issues, respondents who reported their companies had downsized showed higher levels of interest than those from companies that had added workers or stayed the same.

Downsizing? Sort of

One must assume that few (if any) of the Western respondents came from companies that had been involved in supplying the U.S. military. When the survey asked about whether their departments had been affected by downsizing, just 38.5% reported they had the same workload but fewer people to do it (Chart 4). Nearly 10% reported that their companies had actually hired more workers.

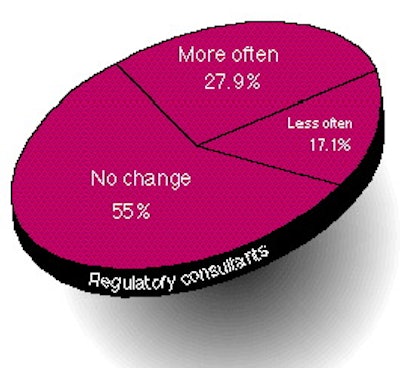

The majority, 51.6%, said downsizing had not affected their packaging operations. Since many companies that cut staff tend to outsource more work, the survey asked Western packagers if their use of outside consultants had changed in the last year. The answers pretty closely parallel the percentages of respondents whose packaging had been affected by downsizing (Charts 5 through 10).

No matter the type of consultant, most respondents said there had been no change this year vs last year. Graphic design consultants got more business from 38.8% of participants, while 10% reported a decline in use of designers. Line integrators, those consultants that coordinate equipment in a packaging line, proved to be the exception. While over 72% reported no change, 18.2% reported less frequent use of line integrators in '95; only 9.1% said they were being used more often. Even more surprising, respondents affected by downsizing reported the biggest decline. Over 28% of these respondents reported their companies used line integrators less in '95.

Where time goes

Finally, PW asked Western packagers about whether they spent more or less time this year responding to certain packaging issues. Because Western states have been leaders in environmental packaging issues, we asked whether they personally spent more time meeting environmental packaging standards this year.

While about half said they spent the same amount of time as last year, over 44% indicated they spent more time on environmental packaging standards. Less than 6% reported less time invested on this issue.

Easily the issue of most importance is tracking productivity on the packaging line. Survey respondents reported more time invested in this in '95. Of all responses, 52.5% reported more time spent on this in '95; only 3.3% said it required less time.

Some 63% reported no change in the amount of time spent in designing packages for recycling, but over 25% spent more time on this in '95. Nearly 38% put more time into designing packages for international shipments this year than last. Fewer than 7% said this task required less time this year.

We also asked Western packagers how they perceived the importance of ISO certification of their suppliers. ISO registration was very important to only 18.5% of Western respondents, while it was not at all important to 16.9%. Obviously, the majority of survey participants answered with more restraint. Nearly four in ten felt it was moderately important, while slightly more than 25% felt ISO certification was of very little importance.

We encourage all readers to evaluate their answers in comparison to this sample of PW's Western readership, and we thank the participants for their cooperation.